Scaling Platform Co-ops with Token-based Financing

Over the past months, several researchers have studied the opportunities for platform cooperatives and decentralized autonomous organizations (DAOs) to learn from each other’s experiences and approaches. This work highlights the potential for decentralized autonomous organizations (DAOs) to learn from cooperatives’ successful experiences in promoting economic and racial justice, effective governance, shared principles, and legally-enforced bylaws. DAOs can benefit from the knowledge and expertise of cooperatives in these areas. Cooperatives can learn from DAOs’ expertise in fundraising, governance, digital community-building, automation, and adaptability. DAOs’ innovative and agile approach can be valuable for cooperatives.

This essay will offer specific suggestions for how platform cooperatives could leverage blockchain-based decentralized applications (dApps) to aid in their growth and scalability.

Risks

Platform cooperatives considering blockchain technology need to be aware of the risks involved. There is an outsized share of scams, hacks, and unethical schemes. New regulations could hamper or make dApps illegal. Tax liabilities are unclear and require extra time and money to navigate. Governance with blockchain technology is still experimental, with legal and practical issues to consider, including the difficulty of ensuring fair governance due to pseudonymous identities and the potential for drama and unclear power dynamics in on-chain governance forums. It is therefore advisable for many cooperatives to seriously consider avoiding blockchain technology altogether.

For those that acknowledge the risks, there are interesting options to be explored.

The cost of “zero trust”

Platform coops, when founded in local communities, tend to be high-trust institutions. Each member-owner is likely to know each other personally due to the geographically localized and participatory nature of operation. This is even more true for coops rooted in feminist principles where caring for individual members is suggested as a key part of meetings.

However, some platform coops aspire to grow larger than local institutions. This is not growth for growth’s sake, but can also be part of the cooperative’s mission to contribute to global public goods infrastructure or to offer high-paying, stable, high-dignity jobs to more people. Platforms that depend upon network effects, such as two-sided marketplaces, require growth to deliver on product goals. Anthropology and psychological research, for example as summarized by Dunbar’s number, suggests that groups larger than 150 – 300 people struggle to maintain close relationships. This is also likely when organic trust becomes more difficult to foster.

Blockchains can address this scalability challenge due to their trust-less nature. These systems combine cryptographic proofs with economic incentives (e.g. Proof of Work or Proof of Stake) to enable secure payments and complex global interactions even among complete strangers. Trust can be placed in the rules and laws encoded by smart contracts, and the economic incentives of the blockchain as a whole, rather than requiring trust in each app participant.

However, there is a high cost to this technology. It costs an average of $0.95 per transaction to send Bitcoin in 2022. Interacting with smart contracts requires paying a transaction fee called a “gas fee”, and the average gas fee on the Ethereum blockchain fluctuates wildly between $1 and over $100. Critically, the costs become prohibitive during times of crisis when people most need to transact. Contrast this to the historic operation of cooperatives, which often sprung up precisely to solve shared problems in the midst of a crisis.

While low-cost blockchains do exist, they tend to have dubious Venture Capital connections that make users wonder if they are the product, or if the chain could vanish as soon as it is deemed unprofitable. An alternative way to achieve lower transaction fees is the roll-up strategy used by Layer 2 blockchains like Arbitrum. However, during a recent promotional campaign, high traffic sent Arbitrum gas fees so high they were required to pause the campaign.

These costs ultimately come from the vision of Ethereum and similar blockchains to create a singular “world computer” where all important transactions are competing for the same “block space”.

An alternative vision which is more compatible with cooperative principles is found in the Cosmos ecosystem, which aims to enable the creation of many “community computers”. Founders of Cosmos like Ethan Buchman and Zaki Manian have explained the differing vision in various podcasts. Buchman points out how Ethereum’s model focuses on rock-solid centralized security, but this comes at the loss of sovereignty in each application and the cost of gas, which we might term “rent” in this context – analogous to various empires of history who offered military protection and shared infrastructure in return for taxes and cultural assimilation. The Cosmos thesis is instead about offering an open-source toolkit that application developers can use to create their own blockchain specific to their application needs and independent from any other blockchains that may have competing values or high traffic. It’s also worth noting that much of the core Cosmos technology is built by a worker coop called Informal Systems.

The Cosmos SDK allows developers to create their own blockchain and then to deploy decentralized apps on top of that blockchain. This is made possible by offering a collection of pre-built modules that solve common blockchain needs. Adopters of this SDK can pick and choose which modules they want, for example the Tendermint consensus protocol, a token bank, or IBC (inter-blockchain communication) which allows Cosmos blockchains to communicate among each other.

By leveraging the Cosmos SDK and creating their own independent blockchain, a platform coop can be freed from the extractive gas models and competing values of blockchains like Ethereum, while also having full control over how the application works.

An exciting thought experiment is to imagine a platform cooperative building a blockchain that could form the foundational layer in which many different kinds of federated coops could deploy and manage their applications. The common issues which face all global platform coops, like how to raise funds, vote on decisions, and distribute earnings could be solved at this blockchain level, drastically reducing the development time and cost for each additional dApp.

Cooperative funding with blockchain

Case studies have shown one of the biggest challenges facing platform cooperatives will be fundraising. Can the blockchain ecosystem help with fundraising?

For example purposes, let’s imagine a platform coop that intends to build a ride-sharing platform like Uber. This is already a crowded space in the platform coop world, e.g. Eva and The Drivers Coop, but was chosen because the product is familiar.

Building or buying the non-trivial app technology for ridesharing or any platform is very costly, and traditional venture funding or bank loans are difficult for cooperative companies to acquire. Traditional grants, crowdfunding, and loans are scarce. In contrast, the overall blockchain and cryptocurrency ecosystem is ripe with capital, even in the 2022-2023 bear market. For examples, see the DAOMaker and TrustPad platforms.

Issuing tokens for fundraising

One mechanism to raise money in the blockchain space is to issue a token representing your project. Theoretically, issuing a token is analogous to equity in the stock market, allowing a company to raise money now in return for the future value they may create.

Token-based financing was pursued greedily in the 2017 initial coin offering craze, without any concrete connection between the token and the product. Nowadays, there is a bit more scrutiny, but those that attract a lot of capital still tend to use less than sustainable means. A common approach is to distribute a growing supply of tokens to incentivize users, not unlike the strategy that venture capital firms used to subsidize ride sharing costs to attract early Uber riders.

Issuing tokens comes with a lot of downsides. Most obviously is the connection to degenerate speculation, which can cause the prices of tokens to vary wildly. A project may raise a sizable sum that evaporates overnight. The other serious problem comes when the token is also used for governance, since the common one-token-one-vote model becomes a de-facto plutocracy.

Dual token model

This challenge of raising money with a token that is also used for governance is a problem that multi-stakeholder cooperatives already face outside of the blockchain world: how to align the interests of supporters and member-owners. A recent survey of shared-services platform cooperatives includes a case study about The Mobility Factory (TMF) which offers an interesting solution in the form of a dual class share system. TMF has Class A shares for user-members, while Class B shares are for supporter-members. The different classes come with different governance rules, with the general idea being to find a balance between user interests with supporter interests. This concept can be combined with the idea of revenue-based financing cited in Austin Robey’s How to Start a Cooperative, to ensure that the Class of shares used for fundraising does not conflict with the Class of shares used for governance.

The above ideas give rise to a proposal for a dual token model. A platform coop could use one token for fundraising, and a completely separate token for utility in the form of governance. Such a model could be implemented on any smart contract platform but would receive additional flexibility and cost-savings if using an application-specific blockchain, e.g. building with the Cosmos SDK as described above.

It is also worth noting that the use of a dual token model where the fundraising token is strictly separated from the utility governance token can also help avoid certain legal headaches, making it less likely that the token is considered a “security” by the SEC and regulated as such.

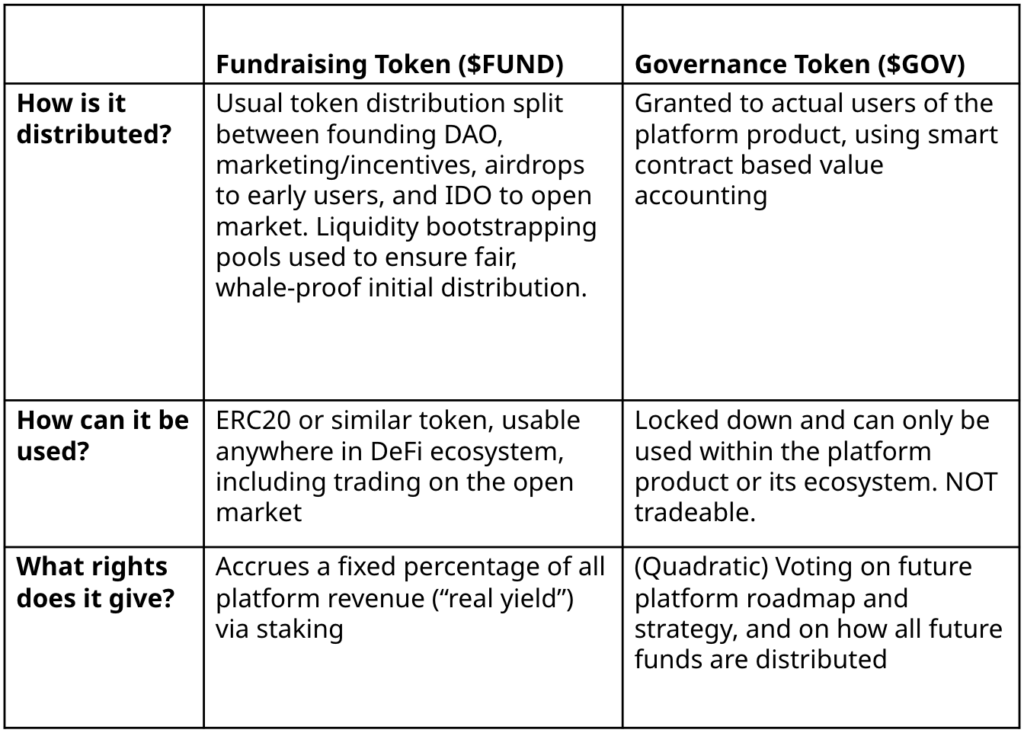

The below table covers the proposal for how each token would be distributed, used, and what rights each affords:

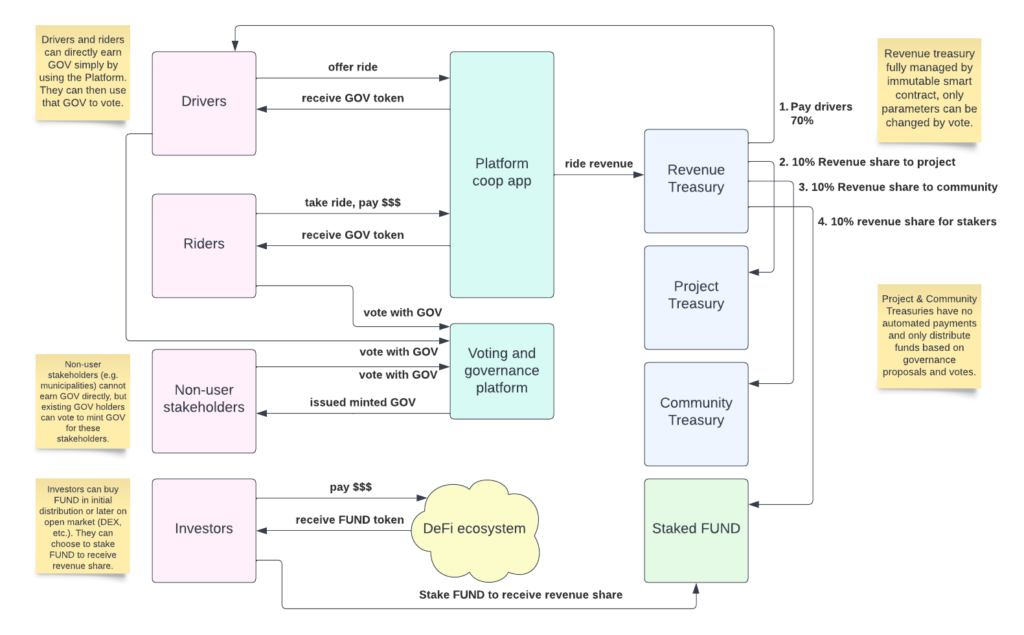

The below diagram shows one example of how this could be structured. The primary idea is to keep the governance token and the fundraising token completely separate, and to prevent trading of the governance token. This would prevent the investors’ speculation on the fundraising token from having any effect on the governance token, which can only be earned by using the actual platform product.

Note: The revenue split above (70 / 10 / 10 / 10) was chosen arbitrarily and is only for example purposes.

Implementing cooperative principles

By leveraging an application-specific blockchain platform like Cosmos and a dual token model for fundraising, all 7 cooperative principles can be achieved. A recent article by Andi Argast considered this exact question in the context of DAOs, and there will be considerable overlap in the ideas I am putting forth below.

1. Voluntary and open membership

As pointed out in Argast’s post, one of the biggest barriers to open membership for blockchain-based apps is the required technical knowledge about computer security and various new tools. For a platform cooperative that aims to offer open membership, the product dApp itself should prioritize an easy user experience. “Play to earn” apps, like Axie Infinity or StepN, offer a good example to follow. They can be downloaded and installed via App Stores like normal smartphone apps, and the user doesn’t even need to know they are using a blockchain. The Eva driver coop takes this even further by accepting regular credit card based payments, despite operating with the EOS blockchain. Banxa is one example of a service that allows receiving normal payments in a dApp.

By automatically minting governance tokens to any person that uses the platform properly, they can become members. No racial, gender, or other demographics would affect this. There wouldn’t be any need for a separate financial investment like buying shares, which should make this open to all economic classes. This would allow anyone able to use the service a way to become a member, fulfilling the principle of open membership.

2. Democratic member control

There is a wide spectrum of decentralized voting tools and mechanisms depending on the exact goals. By combining the typical one-token-one-vote with quadratic voting, the one-member-one-vote ideal described in the principle can be approximated.

To achieve exact one-member-one-vote mechanics on the blockchain combines two active areas of research: 1) Sybil resistance, 2) on-chain identity. Both areas are ripe with experiments, such as on-chain tools like Proof of Humanity, or hybrid tools like BrightID and Gitcoin Passport. The nascent idea of soulbound tokens also promises to address these challenges. These approaches always include a trade-off with privacy and anonymity, but such concerns may not be relevant for a platform coop that intends to build a real community of care and justice.

3. Member economic participation

All income into the platform would be held on the blockchain, controlled by the governance which only members would have voting access to. Members would vote on exactly how that income is distributed back to the dual token holders. The use of blockchain-based value accounting would allow automated, unbiased, and transparent distribution to members.

4. Autonomy and independence

The fundraising token will NOT have any governance rights. This will ensure the cooperative retains its autonomy & independence. No matter how much money an investor poured into the fundraising token, they would not be able to directly control the coop’s decisions or strategy. The use of an application-specific blockchain would ensure full sovereignty over the operation of the platform itself.

5. Education, training, and information

As described under Principle 1, technical barriers to entry for blockchain remain a major challenge. Education would therefore be critical, and dApps should take this principle very seriously. The app should include tutorials on best practices around private key security, as well as explanations for any new concepts.

6. Cooperation among cooperatives

A platform coop could create a blockchain that solves the challenges common to all platform coops, and then make this blockchain available to values-aligned collaborators. One example of how Cosmos is already used to create values-aligned communities is the Kujira blockchain, which only permits dApps that share their values around “grown-up DeFi”.

The use of a Cosmos-based blockchain also comes with the built-in ability for interoperability across blockchains called IBC, so if other platform coops didn’t want to directly deploy their dApps on the same blockchain, they could at least share tokens.

Direct mutual aid to other cooperatives could also be built into the treasury management, voted on by members.

7. Concern for community

Being a multi-stakeholder cooperative with real users from the community as voting members, the community needs would be democratically represented. The presence of the platform coop should also help to create more high-paying, stable, high-dignity jobs in the communities in which they operate.

Furthermore, any federation process of expanding to new geographic locations should include requirements about education and giving back to those locales. One direct financial example is that members could vote to contribute 10% of profits to the local cities where they operate.

Conclusion

I hope this essay was useful to aid in the imagination of building platform cooperatives on the blockchain. Blockchain technology is not a perfect solution and is not expected to be desirable for all platform coops, but for those that need novel ways to fundraise while also building digitally native communities, blockchain technology can help scale the trust and mission beyond local spaces while remaining true to the 7 cooperative principles.

For those interested in going deeper, an expanded version of this article is available as a blog post series on mirror.xyz. Implementing an application-specific blockchain or the above dual-token model will require expertise beyond usual app development. Those interested can contact the author to be put in touch with like-minded communities for education and collaboration.